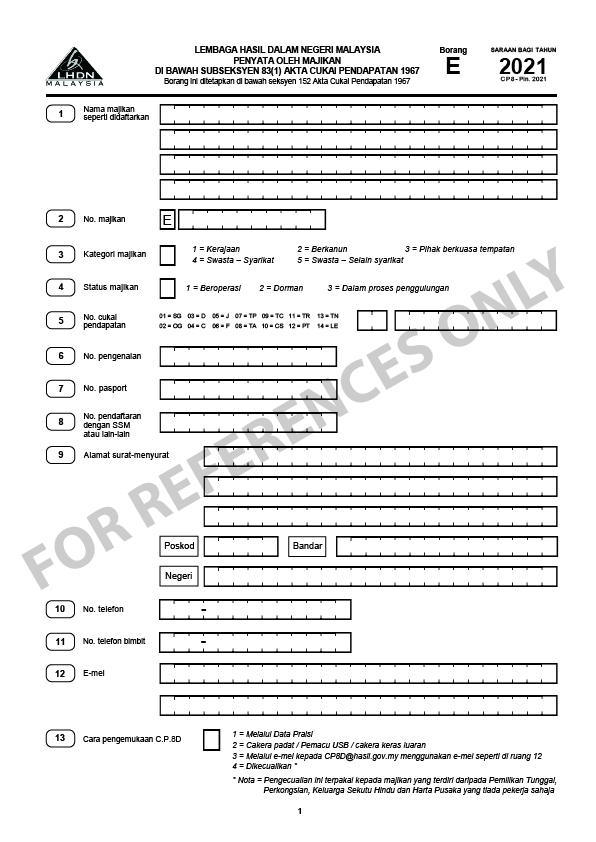

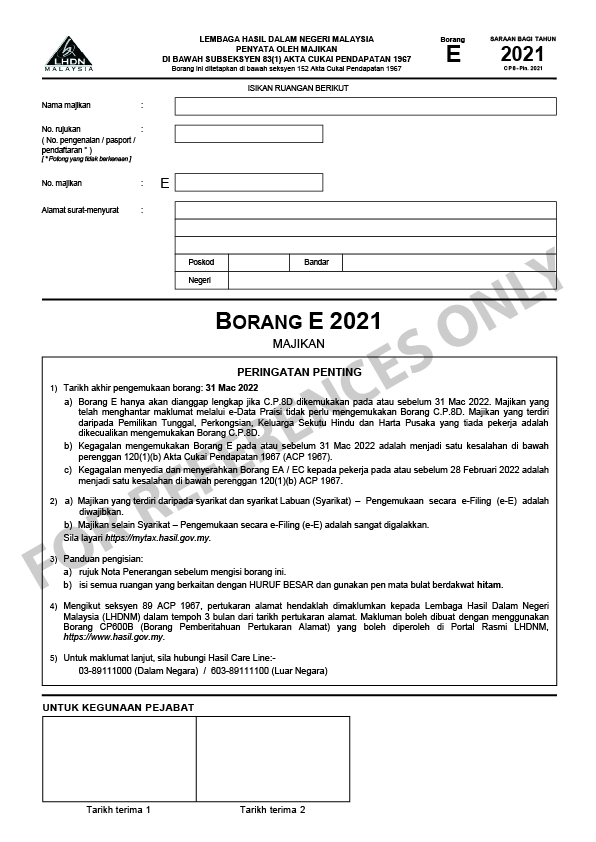

The Borang E must be submitted by the 31st of march of every year. The earnings that are to be included in CP8D.

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

A Form E will only be considered complete if CP8D is submitted on or before 31 March 2020.

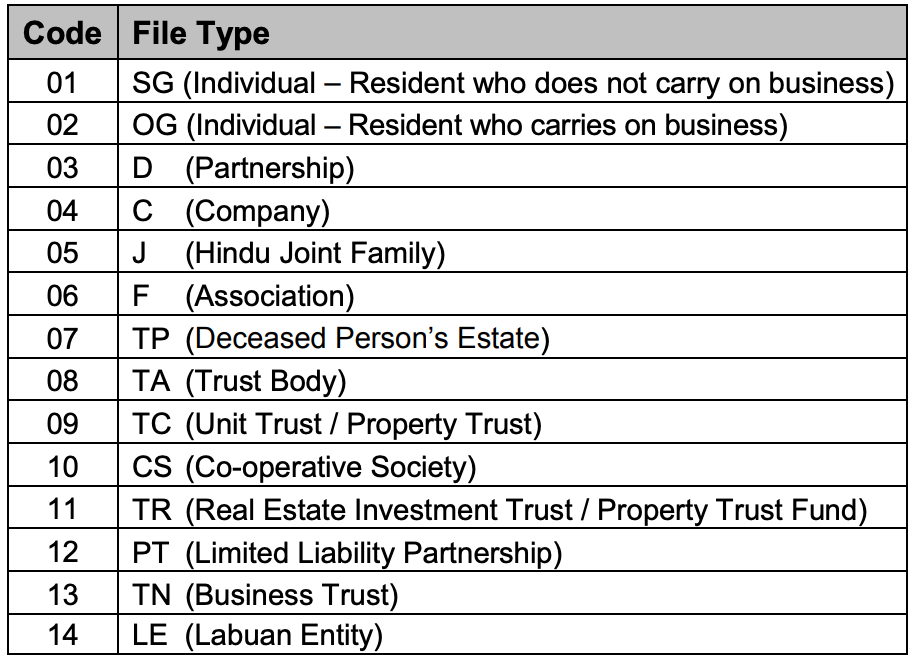

. Details for ALL employees remuneration matters to be included in the CP8D 2019 CP8D has 18 columns to be filled up per employee basis which requires extensive information and the coverage of all ranges of remuneration ie. In addition every employer shall for each calendar year prepare and render to. What is Borang E Form E.

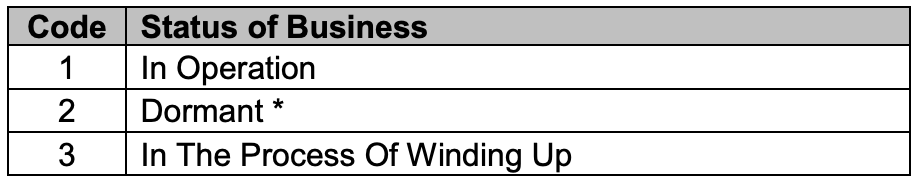

Setelah berjaya log masuk ke sistem ezHASiL skrin Perkhidmatan akan dipaparkan. Any dormant or non-performing company must also file LHDN E-Filing. All companies must file Borang E regardless of whether they have employees or not.

Melalui e filing lhdn online termasuk borang be borang e borang borang ea. Form E is an employee income declaration report that employers have to submit every year. 31 Mac 2020 a Borang E hanya akan dianggap lengkap jika CP8D dikemukakan pada atau sebelum 31 Mac 2020.

In part f of form ea you can file for tax exemptions for certain. Continue button to submit your e-Form. BNCP dan borang anggaran yang disediakan dalam e-Filing adalah seperti berikut.

1 Tarikh akhir pengemukaan borang. Under e-Form tab head to Non-Individual e-E section and select the correct Year of Assessment. Tambahan masa diberikan sehingga 15 Mei 2022 bagi e-Filing Borang BE Borang e-BE Tahun Taksiran 2021.

Sign screen will be displayed as below. Klik pada pautan e-Borang di bawah menu e-Filing. Once you have downloaded the PDF format for Form E you will need log in to ezHasil portal to submit Form E.

April 30 for manual submission. Now youll be able to print save or share the document. B Kegagalan mengemukakan Borang E pada atau sebelum 31 Mac 2020 adalah menjadi satu kesalahan di bawah.

Majikan yang aklumat melalui e-Data Praisi tidak perlu mengemukakan Borang CP8D. Form E Borang E is required to be submitted by every employer company. A minimum fine of RM200 will be imposed by IRB for failure to prepare and submit the Form E to IRB as well as prepare and deliver Form EA to the employees.

Back button To return to previous screen. Select form type e-E and input your Income Tax No. Pilih jenis borang pada skrin e-Borang dan klik tahun taksiran yang berkaitan.

Double check all the fillable fields to ensure full precision. C number and E number. Salaries wages allowance.

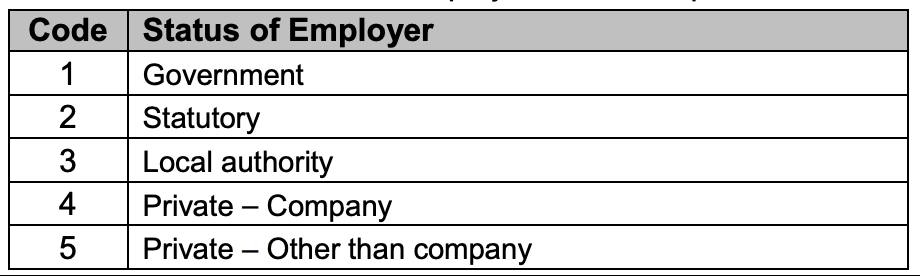

Jika pembayar cukai mengemukakan Borang e-BE Tahun Taksiran 2021 pada 16 Mei 2022 BN tersebut akan dianggap sebagai lewat diterima mulai 1 Mei 2022 dan. What is and how to submit borang e form e. E number is employer.

Failure in submitting Borang E will result in the IRB taking legal action against the companys directors. Muat Turun Borang BE Cukai Pendapatan untuk Tahun Taksiran 2019. Before submitting you will need to sign off the Declaration form.

B Failure to furnish Form E on or before 31 March 2020 is an offence under paragraph 1201b of the Income Tax Act 1967 ITA 1967. Aplikasi e-Filing adalah merupakan sistem yang membolehkan pembayar cukai membuat pengisian dan menghantar Borang Nyata Cukai Pendapatan BNCP dan borang anggaran secara dalam talian. In this example 2019.

Use the Sign Tool to add and create your electronic signature to signNow the Boring e filing then form. ðBorang E yang diterima itu perlu dilengkapkan dan ditandatangani. Borang E contains information like the company particulars and details of every employees earnings in the company.

The deadline for filing tax returns in Malaysia has always been. All partnerships and sole proprietorships must now. Employers who have e-Data Praisi need not complete and furnish CP8D.

BR1M to continue focus on strengthening the economy. Utilize a check mark to indicate the answer wherever demanded. Or Company Registration Number then click Proceed.

Untuk Panduan Pengguna Kali Pertama E Filing Rujuk Di Bawah. Press Done after you finish the document. C number is corporate tax reporting number to report your company tax commonly handle by your company tax agent.

Step 4 key in your company E number Nombor Majikan 请输入E号码. Click on Sign and Submit button to submit your e-Form. Select e-Borang under e-Filing.

Tarikh akhir pengemukaan Borang BE Tahun Taksiran 2021 adalah 30 April 2022. ðIsikan 0 di Bahagian A dan Bahagian B Borang E 2010. Sistem ezHASiL akan memaparkan skrin eBorang seperti di bawah.

Cara Isi Borang e-Filing Online. Print Form Draft button Print form in PDF format. Ada Punca Pendapatan PerniagaanPekerja Berpengetahuan atau Berkepakaran.

Sign and Submit button To submit form. At Declaration screen you are able to. ðMenghantar surat makluman ke Cawangan di mana fail Majikan berada untuk tindakan supaya Borang E tidak lagi dikeluarkan pada masa akan datang sehinggalah syarikat tersebut beroperasi semula.

Fill in your company details and select MUAT NAIK CP8D in the dropdown. Once logged in head to Services e-Filing and select e-Form. Borang Be 2021 Pdf 大马资讯2021年最新版本Borang BE电子报税的步骤.

May 15 for electronic filing ie. Pengguna boleh melengkapkan maklumat. Every company should have 2 number.

Select the Year Assessment you will be filing for.

Understanding Lhdn Form Ea Form E And Form Cp8d

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

How To Step By Step Income Tax E Filing Guide Imoney

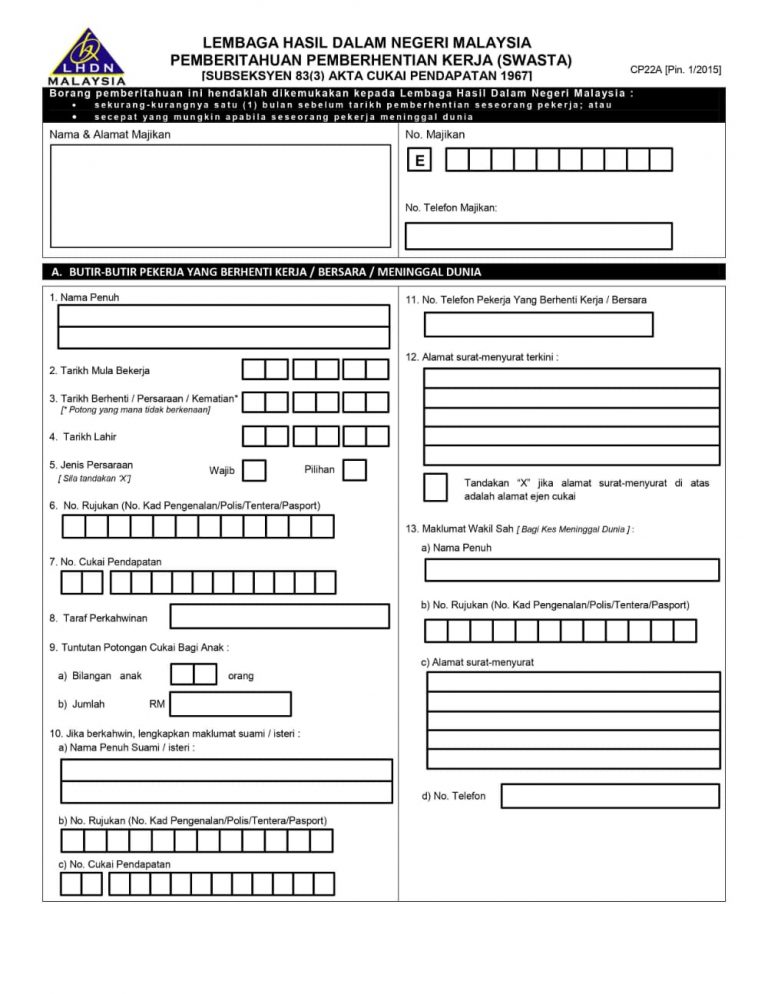

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

Gst Main Cause For Higher Inflation In 2015 Tax Updates Budget Business News

How To Submit Form E With Swingvy Malaysia Youtube

Malaysia Tax Guide What Is And How To Submit Borang E Form E

Malaysia Tax Guide What Is And How To Submit Borang E Form E

Malaysia Tax Guide What Is And How To Submit Borang E Form E

Borang E Archives Tax Updates Budget Business News

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

Malaysia Tax Guide What Is And How To Submit Borang E Form E

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

How To Step By Step Income Tax E Filing Guide Imoney

Malaysia Tax Guide What Is And How To Submit Borang E Form E

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d